On Crypto's Big A: Alpha (& Edges)

You wanna make it, don't you?

This article will answer the questions of what is alpha, edge, and how to begin honing the greatest edge, intuition.

Here is the TL;DR for speedreaders, with the full article below.

What is alpha?

Alpha and edge are different sides of the same coin

Alpha is information you can exploit to make money

What is edge?

Edge is being able to extract yield from the market due to an understanding or skillset the participant has

What are the various types of alpha and edges?

Time-sensitive alpha

Requires an edge of quick thinking and connecting the dots

Example: trading the news - Andre Cronje leaving and his coins - shorting FTM, KP3R, YFI was free money

Mass psychology based (repeated chart patterns due to participant behaviour)

Requires an edge of knowing how to enter/exit with profit

Example: airdrops and bullish exploits, bad news

Airdrops have a pattern anyone can game

Hacks always have a similar pattern: DEUS, Cream, Audius, CEL

Extend this to bankruptcies, and token lockups of 2023 - FTT, SRM, SOL even

The greatest edge you can have is: Intuition

The best edge in any market

You can learn from other people’s mistakes, but you’ll probably only learn from your own

Profit maxis are the true winners of this space, you can love the tech after you’ve made it

Understanding history rhymes, though it is never the same

You cannot profit from the same formula twice

Understand how mass desire is built and shifts, and the catalysts for it to shift and you can harness the power of the markets to multiply your capital by magnitudes

It takes time for mass desire to be built, but once built and accumulated, it moves violently (DOGE, Shib, BTC)

Bonus Edge: Be Like Water, Always

If you can adapt to every single season and narrative without becoming emotional, or getting caught up in the ponzi - that’s how you can consistently profit and build your stack up over time

There will always be another pump, waiting for you to enter before it’s too late.

You must hone, build, and trust your instincts if you want to survive and thrive in this market.

Go to where the money is, and know all tools on a level where you have a basic edge above other participants.

Alpha is defined as:

But in the art of Crypto speculation, alpha simply means:

Actionable information that will make you money.

Knowing this gives a speculator an edge on how to understand alpha, and benefit from it.

There are several types of Alpha in crypto, but in general, alpha has these characteristics:

Time-sensitive, as the market has yet to price in the news or catalyst that will create volatility

Can only be exploited by a select few before the trade/play is exhausted

Combines several fields of understanding (crowd psychology vs news, fundamental smart contract/blockchain tech usage, etc)

Heart’s take on alpha is correct - to a degree, alpha does not exist, edges do.

One can even argue: the desire to be spoonfed alpha, is a sign that the participant has zero edge within the market and will be obliterated with time.

What is an edge in crypto then?

An edge is simply being better at something than other market participants. Maybe it’s synthesising information, playing shitcoins, playing nfts, etc.

No one can have all of the sectors of this nascent asset class mastered - therefore, finding your own specific edge and skill to profit from this game of hot potatoes is needed, or you will be eaten for breakfast, lunch, and dinner.

So perhaps the right phrasing is:

There is always alpha to be found in crypto, but it requires a honed edge to take advantage of them.

And similar to Eugene Schwartz’s theory on headline/market creation as a direct-response copywriter, alpha always changes. And like a knife, edges grow dull with time, and must remain honed, or cease to exist.

“Because no formula works twice”

Look at the charts of the biggest pumps of 2017-2018, 2020-2022, and understand that 99% of them will never break previous ATHs.

Yes, you’re a bagholder, I’m sorry.

The easiest edge in 2020 was knowing that Ethereum would clog up the moment another speculative bubble happened to the asset class, and thus would incentivize participants to bridge to other L1s, creating ponzi upon ponzi of growth.

This was how BNB, Avax, SOL, FTM, Luna, KDA, and many other blockchain VC ponzis pumped to valuations unheard of in any other asset class.

Another edge would be knowing how DOGEcoin runs each market cycle, and simply accumulating it waiting for a breakout as Bitcoin broke its previous ATH of 17k.

Examples of different types of Alpha and Edge coming together:

1. News-based Alpha & Speculation

Picture this: it’s far too late in the bull cycle, the bear is coming through, and uber-dev Andre Cronje announces that he is quitting DeFi.

There is one clear immediate move for any speculator to reap the rewards of this asset class:

Short EVERYTHING Cronje is associated with with reasonable leverage, and reap the rewards.

But to profit from this alpha, you must be part of the first pack of this trade.

Crypto being a market of pure emotion, zero fundamentals and cult of personalities - doesn’t take a genius to know how the market will react to the news. Price will go down, and with hellfire and fury.

https://decrypt.co/94483/yfi-ftm-tank-after-andre-cronje-anton-nell-claim-theyre-leaving-crypto

Note banteg’s tweet in the article: while Yearn will function without Cronje, it had zero impact on the price taking an immediate decline upon announcement of his leaving.

Didn’t stop the price from tanking in a bear market.

This is a classic example of news-led alpha.

Similar to GCR’s rebirth DAO, the ones who were able to find out the approval of a BTC ETF were able to leverage long huge gains into the spike of BTC before our dear ponzi started collapsing.

So news-based alpha is clearly something to exploit in this market.

But then, what edge is needed to exploit this alpha?

The edge is simple:

One must be able to hear news about the market before participants, or take action on news before the market reacts

One must take an immediate decision and speculation on how the market will react to the news catalyst, and have a margin account on derivatives ready to short or long based on the announcement!

One must have the framework to be sure that the decision to speculate is +EV, and has a high probability of occurring. Brain dead simple but true.

Shorting DOGE pumps post bull market have always been free money, but doing that in a raging bull would have liquidated you very quickly

One must then close the speculative position upon fulfilment of the speculative outcome (aka, close before you get squeezed, you fool!)

I have chosen to elaborate on this alpha because I expect this to not be fully gamed out with time, due to the lowered IQ rates and financial knowledge/world understanding of future crypto participants (though the Stanfords will likely be the ones you compete with down the line)

2. Mass Psychology Alpha / Chart Patterns

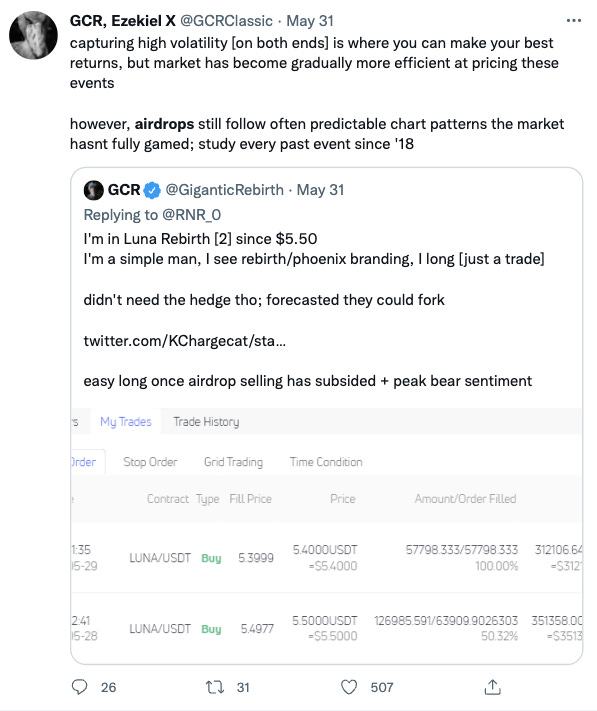

GCR has tweeted that airdrops often follow similar patterns that most market participants have not exploited.

Have a look at these charts, and see the similarities…

LOOKS chart:

Note the initial spike, a second dead cat bounce up before the euthanasia coaster fractal appears once more.

UNI chart:

Note the same movement of price: a rally up as market participants bid the new airdrop, a sharp decline, a dead cat bounce, and a slow bleed out until the bull market of 2021 started kicking in.

APE chart:

Note: APE wicked to $20 on various Cexes upon listing, and could be shorted down to $10 before it was defended, and price rose again. Due to equities rallying, APE ran to $20, before bleeding to single digits in the bear market.

OP chart:

Note the spike close to $1, the upward pulse to $1.50 range before the token bled out in the bear market, and is now seemingly recovering. And of course, later in 2022, it broke ATH, and is now doing decently albeit weak dev energy. (I remain bullish otherwise)

LUNA2 chart:

Note once again, the listing at above $15, the immediate airdrop sell pressure (if you were down on LUNC, you’d obviously try to recoup your fiat losses by selling your LUNA2 airdrop), a 100% rally to $10 due to the eternal hope of a gambling retail market.

Then due to the bear market, a slow bleed out to goblintown. (And some future pumps down the line bc crypto is retarded)

1INCH chart:

Note the defending of the $1 schelling point, similar to Luna2/Ape, and the subsequent relief rally before the 2021 bull market started pumping up the entire asset class.

All these charts show something similar - an immediate drop from airdrop sellers, a weak pump as bottom buyers/order books flip the opposite direction, and then a bleed out before more catalysts lead to further volatile price action.

How does one play that like GCR stated?

There are several ways to do it:

Since we’re talking about airdrops here, make sure you’re Sybil-ing the hell out of any possible ones if you have enough stablecoins to do this (otherwise, keep waging ffs)

Short the airdrop if it is a big one (aka APEcoin), and exit at a bottom

See GCR apecoin schelling point tweet

Buy spot when it bottoms, and sell the repump/reflexive move back up

What is the alpha in this case?

Alpha is: most airdrops tend to play out similar chart patterns, providing free money for those who can play it properly.

Edge required is: knowing when to enter your position, when to close it, and how to control your greed from bottom buying/top shorting so you win, and not lose against the market.

Considering how airdops are still in vogue despite the growth of the crypto asset class - hopefully, this alpha will remain actionable in the upcoming echo bubble later this decade.

3. When buying the dip usually works: Bullish Exploits

In this asset class, for one reason or another - there is free money in nearly every single hack, smart contract exploit or protocol theft - if you understand how to game it.

The game is simple: if there is a hack, wait for the panic selling to finish, buy the dip, and sell the returns as the price has an upward pulse to try and find equilibrium.

Examples: RUNE https://cryptonews.com/news/rune-recovers-11-after-crash-and-thorchain-usd-8m-hack-11175.htm

Down 20%, but up 10%.

DEUS on Fantom: https://bitcoinist.com/hacker-steals-13-million-in-deus-finance-exploit/

Arguably, buying hacks and exploits is a high-risk strategy by any traditional means, but for some reason, it seems to work.

Even buying CEL’s bankruptcy announcement would have netted you a 100% gain in 6 weeks on spot - showing you the idiocracy of this asset class. You’d have made even more just buying the dip, knowing that the bear market would push retail to short CEL to zero, leading to a massive short squeeze (as the chart shows).

Why should a token trade at a 9 figure valuation despite the fact that the company behind it is bankrupt? Who knows.

The alpha in this case: Buying bad news will let you sell the relief rally upwards for consistent monetary gain.

The edge: Knowing how to knife catch (buying red candles with massive volume showing the sellers are getting exhausted), and cashing out with decent returns, not looking for a make-it-in-one-trade play.

So you’ve now seen 3 examples of alpha, combined with an edge, to produce a strong +EV likelihood for the market participant.

When does this not work?

When the mechanism of the exploit is going to send the token to zero - if a hacker’s found a way to mint tokens and sell them relentlessly, it’s not a play to buy, it’s a play to short it to zero

When that 19 year old kid exploited INDX is another example of this.

There is however, the greatest edge that should be analyzed…

The Greatest Edge: Intuition (it’s the tree of life, bro)

The cryptic Shoebill revealing more insights for the average joe.

Defining intuition:

I know a decent-sized crypto whale who cashed out to stables in the vestiges of the bull market before ETH continued its tear towards 3 digits, simply based on… intuition.

How does one develop this edge? How does one use this edge with whatever “alpha” the market is giving, to then turn thousands into millions?

Intuition is an edge that allows you to filter through the noise of the crypto market, and spot projects that aren’t rugpulls, that aren’t scams, and to speculate on the behaviour of market participants.

And as GCR said, “I can’t teach it to you, but you can find edge”

By finding your edge, you can win within these markets, and transition from profit maxi, to actual blockchain maxi.

It should be noted: GCR, a trader who turned several thousand into a comfortable 9 figures, has given mystic clues as to how he personally built his edge that are left on the Internet for those to find.

To understand what the man has said, what is apophenia?

qAnon, Illuminati, Flat Earth, faked moon landings… many of the conspiracies the 21st century homo sapien is surrounded with comes as a result of apophenia.

If you thought in the late bull cycle: “Memecoins have run massively, I’ll just start buying tons of memecoins, they’re going to run like Shiba and Doge!”

Rekt.

If you thought the increased adoption of the blockchain and NFTs in the mainstream were a sign that the market was mature, and that we wouldn’t endure another bear cycle due to how the speculative asset class works?

Rekt.

If you thought the Plan B Supply-2-Flow model would happen, because it seemed to have worked in the past?

Rekt.

So what is, the tree of life?

In this case: GCR uses the term “tree of life”, he is asking the reader to figure out the framework, and the principles at play that led him to making the correct decision, based on his intuition.

The simple intuition at play? Probe going against a trend if it has run its entire course. If everyone’s getting rich and buying, who’s left to buy after the last person has bid BTC?

What direction is the market much more likely to go in as the bull market begins to weigh down on the asset class itself?

Markets are cyclical, and bull markets are often dragged down by their own weight towards the end of their cycles. (Reflections of a Commodity Trader)

I asked a 7 figure friend his perspective on building intuition and an edge, how he perceives the market. His thoughts were:

“I’m a fan of learning the markets the hard way, it teaches you a ton. Only a moron would get repeatedly rekt by influencer shills and Pool2 without learning and adapting.

Since I’ve been in crypto for so long, the way I think about it is:

New information = how can I profit from this?

It’s as simple as that. Do not be anything but a profit maxi until you’ve made it, and then you can be a tech maxi. Cobie’s a great example of this, he’s made it and now tries to help the space in his own way.”

Building intuition is extremely difficult, due to how market participants are swayed by the reflexivity of the market, and how participants get hypnotized by apophenia to see what isn’t there.

Instead, the key is seeing what is there, and what is likely to come with honed intuition.

To hone your intuition/edge, you must then be a participant in the market and understand how the game works.

Don’t buy a shilled coin and be someone else’s exit liquidity just because you like their shitposts on Twitter and it’s the first time they’ve done a 10-tweet thread in decades.

Don’t buy a nameless/anon fork of a new contract without checking the wallet holders, that the liquidity of the contract is locked and that you’re not going to get rug pulled to oblivion.

Don’t fool yourself into believing the market is trending a certain way because you want your bags to get bailed out.

Another tool to build intuition is to study history, and to study markets and events of the past.

By understanding that the plight of man has rarely changed throughout history, and the same desires that caused one to dump their life savings into the South Sea bubble in 17th century England are the same ones that cause you to get rugpulled on a memecoin - you may begin to get a clearer picture of who you’re up against in crypto, and what you’re trying to accomplish in this speculative market.

Referencing back to Eugene Schwartz’s advice on writing headlines as a marketer, there’s another piece of insight you can use to build your intuition:

“The same formula never works twice… that’s why studying charts won’t make you a market wizard”

You can study those charts praying for a fractal that you can spot that will give you the gains you so desperately want, or you can understand the reasons and factors that led to market participants behaving a certain way - as the analysis I provided on gaming airdrop patterns shows.

And remember, most altcoins from 2017 and 2018 never made new highs, and the ones who tried accumulating them in the bear to become rich in a bull did not make it.

It was those who accumulated BTC/ETH as the bear market set in, moved onto accumulating LINK as it grew on its fundamentals, rotated into DeFi summer protocol coins, and then into L1 ponzis and dogcoins that became filthy rich from the 2021 bull market.

It was those who saw the alpha of NFT-based communities and the speculation on them, and accumulated Punks and BAYC-related NFTs before they became vogue that rose out of serfdom.

To wrap this essay up, I will analyze two more pieces of advice from Schwartz:

“You see, people don't change: only the direction of their desires do. They cannot be made to want anything, nor is it necessary to create want. All that is necessary is to be able to channel those wants into the proper products that offer legitimate satisfaction for them.

It takes ten million . . . fifteen million . . . twentvfive million. . . fifty-- million . . . one hundred and fifty million people ... to create a vast market for your goods.

But it takes only one slip of paper—or its recitation by a series of salesmen—to direct all those millions of people to your stores, or vour catalogues, or your wholesalers.

Not one single thing has changed in that regard since I wrote this book. Nor will it ever alter in the slightest. So this book is not about building better mousetraps. It is, however, about building larger mice, and then building terrifying fear of them in your customers. In other words, it is about helping to shape the largest and strongest market possible, and then intensifying that market's reaction to its basic need or problem, and to the "exclusive" solution vou have to offer it.”

The tree of life behind this statement is:

There will always be desire for more - it is the human plight.

Being able to spot how those desires will be channelled, and what will make them buy or sell a particular asset is how you can start to build intuition.

I will leave you with this excerpt from Breakthrough Advertising:

I’ll summarize for you:

The selling of products, the speculation of assets, and science are exactly alike and flow from similar energies. Harness that energy, and you can grow your capital by magnitudes.

How can you learn to harness this energy?

Study past events, study history, participate in the markets and grow your intuition. See what has failed but could work in a different cycle, such as Cryptokitties in 2017/2018 and the resultant NFT class of BAYC, Punks, and other bluechip collections.

The crypto class of ‘21-22 has seen many new types of protocols and mechanisms launch, some failing, some succeeding.

Perhaps digging into what failed, why it failed, and how it could succeed in a new crypto bubble will let you rise up from this current bear market, and make it.

And a Bonus Edge: Be Like Water

Making it in crypto requires a bit of luck, a bit of timing, and most importantly - the ability to adapt and Be Like Water.

You must ride the ponzis of the moment, and the trends of the market, and remove your emotional attachment to it regardless of how you feel. Countless speculators ignored the millions made in NFTs until it was too late, many ignored the rise of Chainlink in the bear, and many lost big trying to keep shorting 2023’s recent pump back up.

You must listen to the market, because it whispers its next move constantly. Observe how prices react to news, how TVL is flowing in an out of a chain, the move of money on-chain - they speak volumes for those who are attentive.

To be a good degen, one must:

Know how to long news trades with leverage with haste, and make out with profits like a bandit

Know how to sybil NFT mints and whitelist spots, regardless of sector/artwork/etc

Know how to read etherscan, and track crucial wallets that are early to a new trend or protocol

Know how to play various protocol setups (Pool 2 farms, OHM forks, bullish hacks, etc)

And most importantly - one must be able to adapt, change bias at a moment’s notice, and to leap headfirst into calculated risk, while keeping an eye out for the exit the moment things take a turn for the worst.

Good luck, fren, you’re gonna need it.

Beautiful.