On Cults In Crypto & How To Profit From Them

Eternal Sunshine of the... Cult Embracing Mind?

One of the best way to make money in cryptocurrency, is to identify cults early before they arise, and to then to cash out near the top, as they baghold the Ponzi to zero.

Done correctly, one can escape the inevitable digital serfdom of the 21st century.

However, being able to do this requires synthesis of several skills to create an “edge” - a way of perceiving the markets and information all participants are given, in a way that allows you to speculate and profit off the mass movement of participants.

Otherwise, your obliteration is but guaranteed.

Let’s get into it…

TL;DR - Cult Identifying 101

Understand the “Mass Desire” and quiet desperation of the market they are dealing with

Search for the confluence of psychological biases and triggers that can entice a mass of men to invest into a project (Fundamentals + psychological conditions + monetary conditions)

Women aren’t the main investors in the space (yet), and the psychological triggers for women are different to men. Understand male behaviour, and you start to understand this market on a deeper scale

Spot the ideal cult leader, and belief system and goal that can convince the market to transfer their life savings into a dodgy token. This is the way.

Ride up the ponzi, add fuel and fire to the cult, and spot the key flipping moment the ponzi cannot sustain itself any longer (Bitconnect, Strongnodes, OHM, TIME, Layer-1 Ghostchains, Move2Earn, Play2Earn, riding the Euthanasia Coaster, as GCR states)

Become a Profit Maxi at all costs. The market is never wrong, it is your decision making that has led you to eat a -85% or -99% loss. You bought the token after all, r-r-r-r-right?

How cults form:

Whether we emerged from caves, aquatic ape forms, descended from Saharan trees or came from space…

Cults exist due to how human beings are coded genetically, and our tendencies to follow leaders and movements in certain traits.

First, understand the bell-curve:

The bell curve is part of the hardwired reason why 99% of market participants lose all the money the market gives them - few are dumb enough to cash out at the top, and few are smart enough to do the same.

The masses of men will always believe the price can go higher or lower, based on whether it is a bull or bear market.

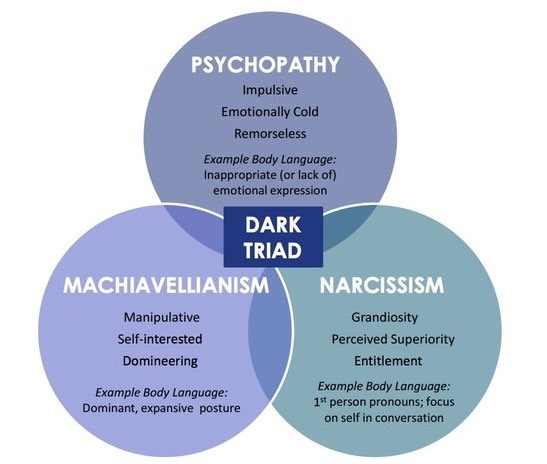

Now here’s the the dark triad of personality traits that our algorithms and social media platforms are incentivized to promote:

Algorithms are specifically designed for engagement, outrage, and continual emotional addiction.

For one reason or another, psychopathic human beings are often the best at manipulating these algorithms to gain fame on YouTube, TikTok, social media, Twitter, or even various elite social circles (See: Theranos, SBF, Anna Sorokin)

For most of history, human beings have not lived under democracies, or the illusion of human rights.

History is littered with endless amounts of destruction, war, genocide, slavery, serfdom, with the ones who survived these transitions being the midwits that latched onto whatever leader was in charge, and didn’t step too far out of line.

The soil of the Earth is littered with the blood of past homo sapiens following the bidding of their leaders. But you’re in the 21st century, so just harness their bags instead.

Point being - you need to understand your competition in this market.

In order for a speculative bubble to form, it requires a mass of people to buy a certain stock or token in hopes of the price increasing beyond their entry point.

A ponzi, but a profitable ponzi nonetheless.

And for the bubble to form, there must be fundamentals of technology on some scale, or an innovation that can justify the formation of a bubble.

From there, crowd psychology, psychopathic leaders and reflexivity then push the bubble to heights unimagined.

The right combination of self-grandiosity, manipulation and psychopathy is what the midcurve is naturally drawn to.

To consistently make money in this asset class, embrace the psychopathic founder who says your size is not size.

Spot these personalities and projects before others do, and set your sells for when the masses will mortgage their houses in desperation to not miss out on “generational wealth”.

P.S. Remember the guy who was leveraging his houses on UST for dat sweet 20% yield? I wonder how that ended.

Let’s get into this with a real example:

Based on “Fundamentals”, Polkadot was considered to be one of the best tokens to accumulate before the peak 2021 bull run, running from a $4-6 range up till $55 at its peak.

But Gavin Wood, despite his British accent and good looks, did not have the charisma or grift of someone like Richard Heart or Andre Cronje.

Meanwhile, Luna faced a possible death spiral at the proper bull market end of May 2021, but was kept alive on life support and continued pumping before it finally succumbed to a Soros-style attack in 2022.

With the leveraged fuelled second fake wave of the “bull” market, it ran up to a near 300x from $0.50 for early holders, to $120 at all time highs. Arguably, what helped drive Luna’s price upward was a psychopathic founder dead focused on conquering the space, and building a cult of “Lunatics” that would destroy any sort of FUD or negative press covfefe.

Similarly, Fantom’s scaling technology never really did work. At peak L1 degeneracy, the chain was ill-functioning, and almost every project on it was a blatant developer cash grab for retail liquidity. However, Fantom was latched upon by actors within the crypto space such as Cronje, Dani, as well as the /biz movement on 4chan, leading to it being one of the best performers PRICE wise.

From $0.01-$0.02 before 2021, to nearly $3 at its peak - it was one of the best performers this market cycle, besides Matic, Luna and Cardano.

Let’s see these charts:

See how DOT was pretty much outperformed by all of them?

(DOT maxis don’t get mad I know some of your ecosystem coins ran 10-50, maybe 100x but the liquidity probably wasn’t enough to cash out your whole bag)

That’s the power of a cult.

So how can you spot and invest in a cult?

3 basic tips…

1. Do not invest or trade solely on fundamentals based on tech. Speculate on fundamentals based on human psychology + a bit of tech.

We love a good hero, and we love turning them into a villain. Spot the heroes before they rise up, long their coins, and short their coins as they turn into villains.

Messi tweeted months before the 2021 cycle top that Dani was the Steve Jobs of DeFi/Crypto/something like that - one of the earliest calls into buying into SPELL, ICE, TIME, before the normies bought the top.

Now, there was a fundamental innovation at the base of SPELL and TIME.

With SPELL, you had a memeable Magic Internet Money stablecoin that made it easy for you to lever up on your shitcoins in a raging bull market.

With TIME, you had OHM (a rebasing ponzi scheme at its core), but on cheaper gas, and better yield. It’s as simple as that.

With these basic innovations + cult = massive pampamentals.

You can buy based on fundamentals, or buy based on cults, pampamentals, and enough technological innovation to trigger a pump - the choice is yours.

There are plenty of examples of such psychopaths within our unique asset class. Richard Heart, Dani Sestagali, Tetranode, Do Kwon, Zhu Su, CZ, and many more.

Build a framework of spotting the right psychopathic tendencies in founders, and when you’ve found one with a brand new token that others haven’t spotted yet - that’s the time to slide the button to the East and enter with haste.

With every investment decision, simply ask yourself: “What will make this go up?”

“What are the pampamentals?”

Don’t midcurve it.

See cult + new tech + possibility of pump = good buy.

How to spot good cult leader? They’re usually:

Narcissistic

Psychopathic

Machiavellianism

Folks I literally gave you a chart at the top of the article, use that lol

You want to look for someone that is willing to make bold statements, willing to take risks, and enjoys being in the limelight.

The most bullish thing about Charles Hoskinson isn’t the tech, it’s his ability to stop his investors from selling with yet another livestream about ethics and peace.

2. Don’t get high on your own Ponzi when you can just buy drugs instead. Seriously

You dumped your life savings with size into an altcoin long. It’s pumping. Your net worth is surging, the fire is in your eyes, your heart is burning with the emotions of escaping years of drudgery with the newfound money in your pocket…

But it’s not your money yet.

It’s only your money when you’ve cashed OUT of the position, and it’s either on stablecoins on a cold wallet that you can’t access easily (so you don’t gamble it away, you filthy animal), or in your bank account, or in some illiquid property that’s losing money but is impossible to sell without a lot of pain.

Countless men have been rekt by believing a green unrealized PnL on their screen is their future.

It isn’t your future yet, fool.

If you want to profit from your Ponzi gamble, cash OUT, and cash out in parts.

Simple strategies for this:

Sell your initial at a multiple of 2-2.5x, and keep selling parts of the profit the higher it pumps (if a high risk position)

If it breaks base support on the pump after you’ve cashed out your initial and there’s profit, sell the entire position to preserve the gains. Simple lines on a chart can work at times. If you sold everything when BTC lost the 50k level but came back up, you would’ve at least kept some gains depending on your entries.

Embrace the high of a pump, but understand that what the market gives, the market takes. Take it from the market before the tide goes out, and you’re swimming butt-naked while Caroline is relentlessly chasing after you on a jetski right after she’s snorted a line of amphetamines (recreationally). Not good. Not good.

Just a heads up: If you live in a Western “democracy” and can consume soft drugs legally, just do that instead of gambling on crypto if you’re not good enough to win at it.

Your coke sugar high with a bucket of fried chicken after you’ve inhaled a joint or two, and staring at some dopamine destroying videos are probably a better way of getting high instead of trying to hype up a bad investment decision on a telegram group at 3am in the morning.

3. There will always be another cult (pump). Always.

If you missed out on a recent pump, don’t fomo. Fomo is the mind killer.

For example: Not one of the silent generation Americans could’ve predicted the British invasion when it happened and the cult of the Beatles.

They probably didn’t predict the Laurel Canyon CIA psyop (look into it) that became a huge cult and still tortures us today with Fleetwood Mac’s Dreams being drummed into zoomer eardrums via endless TikToks today.

You can’t predict the future. We predicted nuclear fission zeppelins and floating cities in the 1920s, all we have today is ElonMa.

But in that time frame, there have been countless cults, pumps, dumps, bubbles, euphorias, and speculative hypes and seasons for any good speculator to take advantage of.

Plenty of 2014 crypto OGs didn’t predict the rise of Ethereum, especially when all there really was then was BTC. Plenty of 2017 OGs didn’t predict DOGE or SHIB.

And plenty of 2021 newbies didn’t predict this recent echo bubble.

Point being:

Missed the cult/pump, move on, look for the next one, there will always be another one.

Always have a checklist when looking at an altcoin or NFT to speculate upon.

What was the starting market cap?

How many holders does it have?

What is the distribution? (Tokens, supply, vesting, etc)

How idiotic are the holders, will they cash out at a certain Schellling point, or HODL it to zero?

What are the current buy/sell pressures on the coin’s spot price?

4. Don’t forget, you can play a cult both ways

First, you can long the cult either on spot or with leverage depending on the token, chain, and mechanisms you can speculate on it with in this market.

Second, if allowed, you can short the cult down with leverage.

Many held $LUNA to absolute zero.

Many did the same with FTM, AVAX, and all the vaporware L1s that inflated to overvalued market caps this previous bull cycle.

These were all lovely shorts for smart traders in 2021-2022.

And recently - STX is a great example of a cult pump (Ordinal hype) you could have profited on the rise off…

And probably short even now with low leverage for some decent gains.

Be cult agnostic, but profit maximalist.

See a cult forming around the Metaverse tokens like SAND, MANA, GALA, etc?

Get into it before it peaks and sell into the hungry masses as they buy the token.

Short it when the sentiment tops and shifts, and don’t get liquidated on a scam wick.

To wrap this article up, let’s recap the TL;DR bullets with some addendums…

Understand the “Mass Desire” and quiet desperation of the market you’re dealing with - many will never drive the Bugatti or sleep with dat Romanian 10. They’ll pay for the OF videos though. Many will never live like the top 1%, but that desire will push them to ape their wage savings into a pump.

Search for the confluence of psychological biases and triggers that can entice a mass of men to invest into a project (Fundamentals + psychological conditions + monetary conditions)

Fundamentals: new innovation forms, sparking interest as well as participation from the market

Psychological conditions: there is space and a void within the market for a narrative and a persuasive hook to take place in the mind of participants, convincing them to inject liquidity into an asset class muh muh Echo Bubble

Monetary conditions: the participants have enough money to actually participate lol it’s that simple

Spot the ideal cult leader, and belief system and goal that can convince the market to transfer their savings into a dodgy token

Understand the mechanics that fuel the ponzi, and how and when it will collapse

$LUNA works bc of yield, $FTM bc it’s cheaper and smaller, $STRONG bc it’s stable yield, $CRV bc muh DeFi stable liquidity, etc etc.

Know the reasons why they pump and you can spot when the reasons are fading in strength, and GTFO with some gains to spare

Ride up the ponzi, add fuel and fire to the cult (shill it, you fool!), and spot the key flipping moment the ponzi cannot sustain itself any longer (Bitconnect, Strongnodes, Ohm, Time, Layer-1 Ghostchains, Move2Earn, Play2Earn, riding the Euthanasia Coaster, as GCR states)

Actual TA - always sell that base support break/bounceback before it’s too late. If the base support of a parabolic trend breaks, chances are, it’s over. Get the hell out with gains and wait for the next easy pump to gain from!

Speculating in cryptocurrencies could not be simpler than this.

Now, actually making money, that’s a different question altogether.

But this article should already have given you several insights you can use for your next play.

Want more bubbles to study?

Here are some good examples of bubbles for you to Google and read about:

South Sea Bubble. Newton gets so rekt from this, he bans his domestic servants from saying South Sea in his presence ever again, fr fr cap af, not bussin’

Tulip Bubble. People got so nuts about these things when credit and leverage was available on them they nearly killed a dude for digging up one and cutting it open. They were also worth a ton of money at the top.

DeFi Bubble: Uniswap, Sushiswap, and Chainlink Oracles allowed people to finally borrow properly on chain, and speculate on $FOOD related tokens as well as basic $MEME NFTs. YFI made millionaires out of a new smart contract innovation, and so did the early DeFi airdrops/blue chips (now DownOnly) that came out then.

The Link Marine (Chainlink) bubble - Spend some time googling how Link was a 4chan favorite, and all the autism, memes, and cultish behaviour that surrounded it. It’s a good case study on a project that was… “too risky to hold”. (bonus points if you get that reference)

Want to read further about the psychology of the masses and to understand this more? Some books for you might be:

The True Believer - Eric Hoffmann

Propaganda - Bernays

Mastering the Market Cycle

Persuasion - Eric Cialdini

As of publishing this article - we may be in the early innings of the upcoming bull market.

All the work you (should’ve) done in the bear is hopefully paying off.

So as I always say…

Eternal Sunshine of the Pump Embracing Mind.

Hope you enjoyed this article!

big brain, the first time I get the same emotion as reading GCR's tweets.

GG shit Tyrogue. GG indeed.